Writeup for Dex

- Hello h4ck3r, welcome to the world of smart contract hacking. Solving the challenges from Ethernaut will help you understand Solidity better. Each challenge involves deploying a contract and exploiting its vulnerabilities. If you’re new to Solidity and haven’t deployed a smart contract before, you can learn how to do so using Remix here.

Challenge Description

The goal of this level is for you to hack the basic DEX contract below and steal the funds by price manipulation.

You will start with 10 tokens of token1 and 10 of token2. The DEX contract starts with 100 of each token.

You will be successful in this level if you manage to drain all of at least 1 of the 2 tokens from the contract, and allow the contract to report a “bad” price of the assets.

Contract Explanation

If you understand the contract, you can move on to the exploit part. If you’re a beginner, please read the Contract Explanation to gain a better understanding of Solidity.

Click to view source contract

1

2// SPDX-License-Identifier: MIT

3pragma solidity ^0.8.0;

4

5import "openzeppelin-contracts-08/token/ERC20/IERC20.sol";

6import "openzeppelin-contracts-08/token/ERC20/ERC20.sol";

7import "openzeppelin-contracts-08/access/Ownable.sol";

8

9contract Dex is Ownable {

10address public token1;

11address public token2;

12

13 constructor() {}

14

15 function setTokens(address _token1, address _token2) public onlyOwner {

16 token1 = _token1;

17 token2 = _token2;

18 }

19

20 function addLiquidity(address token_address, uint256 amount) public onlyOwner {

21 IERC20(token_address).transferFrom(msg.sender, address(this), amount);

22 }

23

24 function swap(address from, address to, uint256 amount) public {

25 require((from == token1 && to == token2) || (from == token2 && to == token1), "Invalid tokens");

26 require(IERC20(from).balanceOf(msg.sender) >= amount, "Not enough to swap");

27 uint256 swapAmount = getSwapPrice(from, to, amount);

28 IERC20(from).transferFrom(msg.sender, address(this), amount);

29 IERC20(to).approve(address(this), swapAmount);

30 IERC20(to).transferFrom(address(this), msg.sender, swapAmount);

31 }

32

33 function getSwapPrice(address from, address to, uint256 amount) public view returns (uint256) {

34 return ((amount * IERC20(to).balanceOf(address(this))) / IERC20(from).balanceOf(address(this)));

35 }

36

37 function approve(address spender, uint256 amount) public {

38 SwappableToken(token1).approve(msg.sender, spender, amount);

39 SwappableToken(token2).approve(msg.sender, spender, amount);

40 }

41

42 function balanceOf(address token, address account) public view returns (uint256) {

43 return IERC20(token).balanceOf(account);

44 }

45

46}

47

48contract SwappableToken is ERC20 {

49address private \_dex;

50

51 constructor(address dexInstance, string memory name, string memory symbol, uint256 initialSupply)

52 ERC20(name, symbol)

53 {

54 _mint(msg.sender, initialSupply);

55 _dex = dexInstance;

56 }

57

58 function approve(address owner, address spender, uint256 amount) public {

59 require(owner != _dex, "InvalidApprover");

60 super._approve(owner, spender, amount);

61 }

62

63}

They gave us a DEX contract. DEX refers to Decentralized Exchange where we can do financial ativities such as swapping tokens.

The contract inherits Ownable contract. Click here to view the Ownable contract.

The Ownable contract has the state variable owner and it is initialized to msg.sender in constructor(). That mean’s owner will be the person one who is deploying the Dex contract.

The Dex contract has two state variables token1 and token2. Both the state variables are of type address.

1function setTokens(address \_token1, address \_token2) public onlyOwner {

2token1 = \_token1;

3token2 = \_token2;

4}

This function will set the address of token1 and token2.

1function addLiquidity(address token_address, uint256 amount) public onlyOwner {

2 IERC20(token_address).transferFrom(msg.sender, address(this), amount);

3}

The above function addLiquidity() will take two arguments of type address (token_address) and uint256 (amount) as input. Basically the function will add more tokens of the token_address passed during the call. It can be only called by owner because it has onlyOwner modifier.

Since the Dex contract is a Decentralized Exchange used for swapping tokens, there should be at least two tokens accepted in the Dex contract. Suppose the Dex contract accepts two tokens, token1 and token2, for exchange. If people swap token2 for token1 and all of token1 is depleted in the Dex contract, it can no longer facilitate swaps. Therefore, when one of the tokens becomes very scarce, the owner will add more of the scarce token to ensure the Dex continues to function.

1function swap(address from, address to, uint256 amount) public {

2 require((from == token1 && to == token2) || (from == token2 && to == token1), "Invalid tokens");

3 require(IERC20(from).balanceOf(msg.sender) >= amount, "Not enough to swap");

4 uint256 swapAmount = getSwapPrice(from, to, amount);

5 IERC20(from).transferFrom(msg.sender, address(this), amount);

6 IERC20(to).approve(address(this), swapAmount);

7 IERC20(to).transferFrom(address(this), msg.sender, swapAmount);

8}

The above function swap() will take three arguments of type address (from), address (to), uint256 (amount) as input. In the logic part first it will check whether the swapping is done between the allowed tokens (token1 and token2) or not. If the users use any other token for swapping which is not allowed by Dex contract then it will revert. Then it checks whether the user is having the tokens they are swapping or not. Then it will get the swapAmount using the function getSwapPrice() .

swapAmount is basically when user wants to swaps token1 with token2 they will send token1 to Dex contract and Dex contract will send the user token2. But the number of tokens sent by user and the number of tokens sent by Dex contract won’t be same because the price of token1 and token2 might not be same. Based on the price difference getSwapPrice() will return the number of token2 user will get for swapping with toke`n1.

1function getSwapPrice(address from, address to, uint256 amount) public view returns (uint256) {

2 return ((amount * IERC20(to).balanceOf(address(this))) / IERC20(from).balanceOf(address(this)));

3}

The above function getSwapPrice() will return then number of tokens user will get for swapping with another type of tokens.

1function approve(address spender, uint256 amount) public {

2 SwappableToken(token1).approve(msg.sender, spender, amount);

3 SwappableToken(token2).approve(msg.sender, spender, amount);

4}

The function approve() takes two arguments: an address (spender) and a uint256 (amount). The function calls the approve function in the SwappableToken contract. SwappableToken is a basic ERC20 contract. The approve function in the Dex contract calls the approve function in the SwappableToken contract, passing msg.sender, spender, and amount as arguments. This allows the spender to spend the specified amount on behalf of msg.sender for both the tokens.

1function balanceOf(address token, address account) public view returns (uint256) {

2 return IERC20(token).balanceOf(account);

3}

The above function balanceOf() will take two arguments of type address(token) and address(account) as input . The function will return the balance of the account in token passed.

Key Concepts To Learn

Before starting to solve this challenge we need to make sure that we have a good understanding of ERC20 tokens.

I have explained about ERC20 contract in the Token challenge. Click here to open the WriteUp for that challenge.

Exploit

In the challenge we was given 10 tokens of token1 and token2 and the Dex contract is having 100 tokens of token1 and token2. Our task is drain one of the token balance of Dex contract.

After looking into the Dex contract, I felt like everything is working fine except the getSwapPrice() function. If we see the getSwapPrice() function, we can find that the logic the function uses is not correct to get the swapAmount.

The formulae for calculating swapAmount is ((amount * IERC20(to).balanceOf(address(this))) / IERC20(from).balanceOf(address(this))).

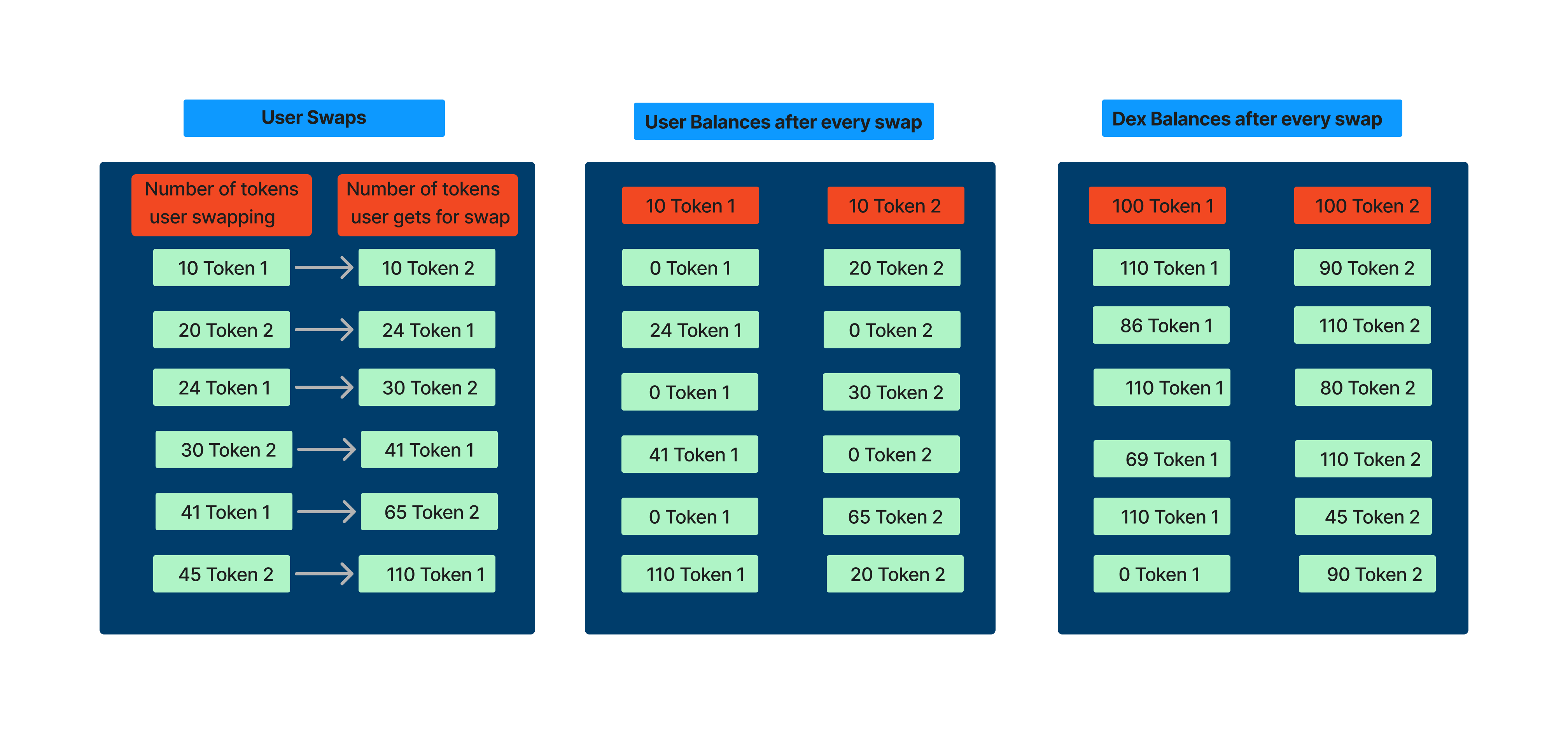

When we swap our 10 token1 for token2 we will get 10 token2 based on the getSwapPrice() function. Now we have 0 token1 and 20 token2. The next time when we swap our 20 token2 for token1 we will get 24 token1 . The next time when we swap 24 token1 for token2 we will get 30 tokens. So on it will continue. Check the below image to view how swapAmount is manipulated in each swap.

First we will swap

10 token1and we get10 token2. swapAmount is(10* 100/100)=10so we get10 token2. After this swap Dex contract has110 token1and90 token2.For second time we swap our

20 token2and we will get24 token1. swapAmount is(20* 110/90)=24. So we get24 token1. After this swap Dex contract has86 token1and110 token2.For the third time we swap our

24 token1and we will get30 token2. swapAmount is(24*110/86)=30. So we get30 token2After this swap Dex contract has110 token1and80 token2.For the fourth time we swap our

30 token2and we will get41 token1. swapAmount is(30 *110/80)=41. So we will get 41 tokens1. After this swap, Dex contract has 69 token1 and 110 token2.For the fifth time we swap our

41 token1and we will get65 token2. swapAmount is(41*110/69)=65. So we will get65 token2. After this swap Dex contract has110 token1and45 token2.For the sixth time we swap only

45 token2and we will get110 token1. swapAmount is(45*110/45)=110. So we will get110 token1. After this swap, Dex contract has0 token1and90 token2.

During the sixth swap, we only swap 45 token2 because if we swap more than 45 then swapAmount will be more than the Dex contract balance. Suppose we swap 50 token2 then we will get swapAmount as (50*110/45)=122 122 token1 which means in return we will get 122 token2 but the Dex contract only has 110 token2. So it will revert if we try to swap more than 45 token2 in the last call.

Now lets exploit the contract.

Before calling swap() function we need to make sure that we have allowed the Dex contract to send tokens on our behalf because when we swap token1 for token2 we are sending our token1 to the Dex contract and the Dex contract will send us token2. But we are not directly transfering the ether instead the Dex contract uses transferFrom() to receive our tokens.

IERC20(from).transferFrom(msg.sender, address(this), amount) you can find this line in swap() function.

Now it’s time to open the console. Open Dex challenge and enter ctrl+shift+j to open the console.

1> await contract.approve(contract.address,1000)

1> token1=await contract.token1()

2> token2=await contract.token2()

1> await contract.swap(token1,token2,10)

1> await contract.swap(token2,token1,20)

1> await contract.swap(token1,token2,24)

1> await contract.swap(token2,token1,30)

1> await contract.swap(token1,token2,41)

1> await contract.swap(token2,token1,45)

Once the above calls are done the Dex contracts token1 balance will be zero. We can verify it by the following.

1> (await contract.balanceOf(token1,contract.address)).toString()

Now you can submit the level instance.

***Hope you enjoyed this write-up. Keep on hacking and learning!***

Key Takeaways

Single Source Data Vulnerability: Relying on a single source for prices or any data in smart contracts introduces a significant attack vector. An attacker with substantial capital can manipulate the price, leading to incorrect data being used by dependent applications.

Decentralization vs. Centralization: While the exchange itself may be decentralized, the asset’s price can still be centralized if it comes from a single DEX. This centralization makes it susceptible to manipulation.

Mitigation through Multiple Sources: Using tokens that represent real assets, which have exchange pairs across multiple DEXes and networks, can mitigate the risk. This diversification reduces the impact of any single DEX targeted by an attack.

Comments